25+ Va loan amount calculator

To calculate how much house you can afford use the 25 rule. Todays national VA mortgage rate trends.

How Refinancing Your Student Loans Can Save You Thousands Conscious Coins Paying Off Student Loans Student Loans Refinance Student Loans

However if you have entitlement in use that will not be restored your new VA loan must still be over 144000 and the Freddie Mac county loan limit will factor.

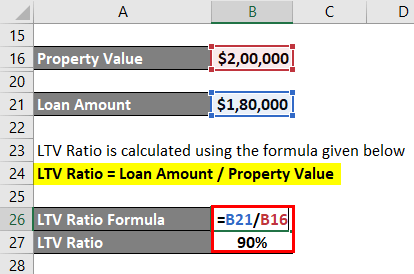

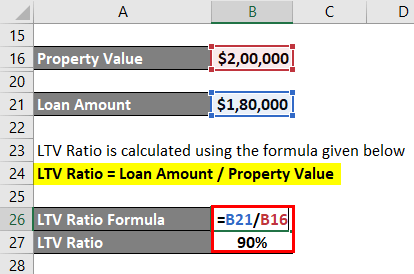

. I want your home to be a blessing not a curse. In the UK and US 25 to 30 years is the usual maximum term although shorter periods such as 15-year mortgage loans are common. The VA will only guarantee 25 of the refi amount and most lenders cap the loan-to-value limits on cash-out refinancing at 90.

Enter an amount between 0 and 25. VA loans are unique because the lender. Rhode Island Student Loan Authority or RISLA is a Rhode Island-based nonprofit that refinances loans for customers across the country.

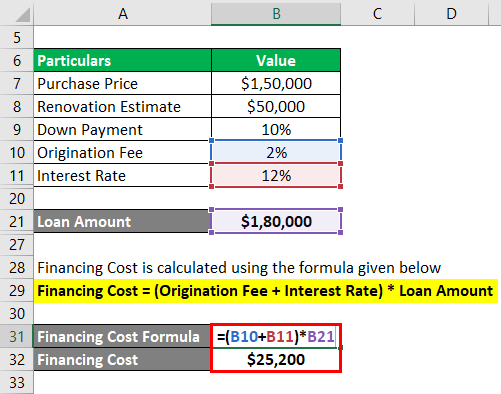

Use the VA entitlement worksheet to calculate your maximum VA loan amount. P Principal Amount initial loan balance i Interest Rate. And the fee is usually included in the loan so it increases your monthly payment and adds to the interest you pay over the life of the loan.

Lets say you purchased a home three years ago for 300000 and used 75000 of your VA entitlement and youre looking to use your VA loan benefit to purchase a second home. Different Types of VA Loan Entitlement. 5 or 5 of the amount of the transfer whichever is greater.

The Math Behind Our Mortgage Calculator. There are two parts to VA entitlement. Todays national mortgage rate trends.

Your loan term is the amount of time you have to repay the loan in full. Select the Funding Fee Select fee 000 100 125 140 165 230 360. Applicants will have to provide proof of income and assets and the lender will run a full credit history.

Using the Mortgage Income Calculator Loan information. Enter an amount between 0 and 25. But the good news is a 15-year mortgage is actually paid off in 15 years.

30 years the loan amount and the initial loan-to-value ratio or LTV. It stands apart for its income-based repayment program. Getting The Most Out of Using This Calculator.

Use this calculator to calculate your VA Max Mortgage from your remaining VA Entitlement also called VA Loan Second-Tier Entitlement and see if you will need a down payment. See the current VA Loan Limits by county or use our VA Loan Limit calculator to quickly calculate the VA Loan Limit in your area. For federal student loans under a standard repayment plan the default loan term is 10 years.

Youll notice that the required income and a calculation of the monthly mortgage payment immediately appear in the. This certain amount is called entitlementit can be either 36000 or 25 of the loan amount. N Number of Monthly Payments for 30-Year Mortgage 30 12 360 etc How to Use Our Mortgage.

Mortgage Original Loan w Extra Mortgage Payment a Year. How does VA refinancing work. Begin by entering the desired loan amount expected mortgage rate and loan length in the spaces provided.

M Monthly Payment. Discount points typically cost 1 percent of the loan amount and lower interest rates by about 025 percent. Never spend more than 25 of your monthly take-home pay after tax on monthly mortgage payments.

Your new VA loan must be on an owner occupied primary. Start by getting a preapproval to make sure youre. Following this rule keeps you safe from buying too much house and ending up house poor.

Annual mortgage insurance premium. 5 percent of the loan amount. Maximum interest rate is 20.

For those who want to know exactly how our calculator works we use the following formula for our mortgage calculations. Alliant Visa Platinum Credit Card. However 30-year fixed mortgages usually come with 025 to 1 percent higher rates compared to 15-year fixed-rate loans.

Anything above that mark would require a down payment equal to 25 percent of the. Figure out 25 of your take-home pay. 0 intro APR for 21 months on balance transfers 15992599 variable 0.

Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages. Otherwise the requirements for VA cash-out refinancing are not dissimilar to those governing the FHAs program. So yes you can have more than one VA loan.

Start interest rates at. The VA-authorized private lender The VA caps the lenders compensation on VA loans to 1 of the total loan amount. For a 250000 loan that could mean a difference of more than 100000.

Most eligible service members and Veterans start with a basic entitlement of 36000. 045 percent to 105 percent depending on the loan term 15 years vs. That means cash-out refinance rates might be around 0125 to 025 higher than VA loan rates you see advertised online.

Because the VA guarantees a quarter of the loan amount the maximum entitlement in this county is currently 161800. Since the VA will guarantee a quarter of the total loan amount this gives the majority of borrowers 144000 to work with 36000 x 4. Check out our VA Loan Calculator to see what you can afford.

The amount is typically a quarter of the loan amount which reflects the VAs 25 guaranty. A borrower who has not used their VA loan benefits or has repaid their previous loan fully. About 15 per cent of the loan amount.

For today Thursday September 15 2022 the current average rate for a 30-year fixed mortgage is 619 increasing 11 basis points compared to this time. 7 On a 300000 loan that fee can be anywhere from 420010800. A 15-year loan does come with a higher monthly payment so you may need to adjust your home-buying budget to get your mortgage payment down to 25 or less of your monthly income.

However in the United States the average interest rates for fixed-rate mortgages in the housing market started in the tens and twenties in the 1980s and have as of. Todays Mortgage Rates Today the average APR for the benchmark 30-year fixed mortgage remained at 3. Youre required to pay a VA loan funding fee between 1436 of the loan amount as of 2020.

Cant exceed 1 of the loan amount Paid to. For today Thursday September 15 2022 the national average 30-year VA mortgage APR is 5650 up compared to last weeks of 5480. Request a free VA loan rate quote here Sep 15th 2022 For detailed information about the funding fee visit our funding fee page.

This calculator uses your original loan amount length of the loan and interest rate to calculate your current.

25 Jobs That Provide Free Housing Seasonal Year Round And Abroad

Hard Money Loan Complete Guide On Hard Money Loan With Example

25 Great Shipping Container Swimming Pool And Their Benefits Interior Design Piscine Creusee Piscines De Reve Idees Jardin

Simple Budget Planner Worksheet Fillable Personal Etsy Budget Planner Worksheet Budget Planner Finance Organization Printables

Mcdonald S Delusional Budget For Low Wage Workers Mcdonald S Is Admitting That A Full Time Worker At One Of Their Budgeting Budget Planning Budgeting Finances

Standard Iaa Licensed Buyer Fees Iaa

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-03-4346254c24b54206b3dda8692d4f0f7c.jpg)

Employee Stock Options Esos A Complete Guide

Help My Client Is Questioning Pr Value What Should I Do Como Economizar Dinheiro Ganhar Dinheiro Online Financas

Va Home Loan Refined Lending

Bankruptcy How To Make A Budget Conner Law Blog Budgeting Worksheets Budgeting Making A Budget

Hard Money Loan Complete Guide On Hard Money Loan With Example

Loan Help Me Please R Sdsu

How Interest Rates Can Impact Your Monthly Housing Payments Mortgage Loans Mortgage Calculator Reverse Mortgage

Free Printable Family Budget Worksheets Family Budget Worksheet Budgeting Worksheets Budget Template Printable

Daily Habits Of 8 Top Real Estate Agents Real Estate Infographic Top Real Estate Agents Real Estate Tips

What Comes After A Seller Accepts Your Offer Infographic Real Estate Infographic Real Estate Tips Real Estate Marketing

Personal Loan Personal Loans Banks Ads Photo Album Layout